By Dave Ayre, CIPFA Property Networks manager

The housing crisis has been growing over the last 40 years and arguably before that with cuts in housing expenditure in the aftermath of the 1967 sterling crisis. Analysis of housing completions since the Second World War show that the government’s target of 300,000 homes built per year cannot be achieved unless councils are given the freedoms and funding to build social homes for rent at scale.

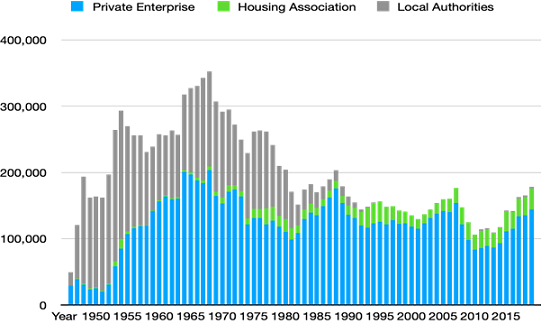

Housing completions 1945-2019 (Source: MHCLG Table 244)

The statistics tell the story of the devastating impact of market cycles on new-build housing delivery. They also show the heroic contribution made by local authorities to overall house building in the post war decades and the stark impact of cuts to funding for council house building which started following the 1967 sterling crisis.

Completions continued to fall throughout the early 1970s, as rising inflation and interest rates put pressure on government spending on housing. The Labour government increased housing expenditure in the early years of its term, both to boost construction, but also because high interest rates were driving up the cost of mortgage tax relief. However, following the 1976 sterling crisis and agreements with the IMF to cut public spending, capital spending on housing took a large cut. The number of completions continued to fall over the rest of the decade.

In 1979 the balance of delivery of 209,460 homes was 57% private enterprise and 35% local authority, with eight per cent by housing associations. By 1989 we relied on the private sector for 86% of the 179,360 homes that marked peak output pre-1990 recession. By 2007 local authorities were delivering just 0.0014% of new homes, while housing associations' share grew to 12% of completions. The fragility of this arrangement was highlighted by the 'Great Recession' of 2008/2009, which swept away a third of SME housebuilders. With further consolidation since, just ten housebuilders were responsible for 47% of new homes built in the country in 2019. Meanwhile, housing associations maintained slow, if steady, growth in share throughout the 40-year period, delivering 18% of homes completed in 2019.

The demise of council house building and the reduction in social housing grant by more than 50% as part of the austerity response to the post 2007-08 global banking crisis has forced a greater reliance on the housing market for all forms of affordable housing. Funding from section 106 agreements, the community infrastructure levy and the increasing use of cross-subsidy from the sale of market homes by housing associations are all subject to the boom and bust cycle of the housing market. What is needed is a counter-cyclical approach.

The longstanding belief by successive governments from 1979 in the power of the market to address housing need began to soften in 2017 when then-Prime Minister Theresa May wrote in the foreword to the housing white paper that "our broken housing market is one of the greatest barriers to progress in Britain today. Whether buying or renting, the fact is that housing is increasingly unaffordable – particularly for ordinary working class people who are struggling to get by."

This tentative recognition of the reality facing many people, that the market could not make housing available to those who could not afford it, led to the introduction of the Help to Buy scheme and funding for councils through the Homeless Reduction Act 2017. May's government also recognised the role of councils by lifting the borrowing cap on Housing Revenue Accounts – signalling the need for councils to start building homes for social rent once again. These changes stemmed some of the worst increases in rough sleeping and homelessness.

More recently the 2021 Spring Budget extended the stamp duty holiday and introduced a mortgage guarantee scheme, Chancellor Sunak's only other housing reference being to the support provided to house buyers. There was no reference to social housing but there are still small signs of movement. The Government has agreed to increase the time limit on local authorities use of right to buy receipts from 3 to 5 years before transferring them plus interest back to the Treasury for re-allocation to Homes England. This is in recognition that during the period of higher income from right to buy receipts between 2013-2016, 75% of the income generated was returned to the Treasury, making it difficult to invest in new stock.

These modest concessions are a reluctant acknowledgement that councils are part of the solution, but to meet house building targets there needs to be a greater recognition of the structural imbalance in housing provision that is the legacy of housing and welfare policies over the last 40 years. There needs to be a step change in council house building, needed more than ever if the COVID-induced recession supresses the supply of homes through the market. A counter-cyclical investment in zero-carbon council housing will give the economy the green-growth injection it needs to bounce back post-COVID. The success of the Everyone In initiative shows what councils can do to respond to a crisis, but to step up to the wider structural housing problem, the current trickle of housing authorities deciding to re-establish their Housing Revenue Accounts needs to become a flood.

Explore more

Further support is available through our Housing Advisory Network (HAN), including webinars and training. Plus, our Tackling The Housing Crisis page offers more resources and insight.