By Dave Ayre, CIPFA Property Networks Manager

The Bacon Review, the prime minister's review of custom and self-build housing, is enthusiastic about the prospects and potential of this market sector. Whilst it has a contribution to make to improve the quality of new housing, does it really have a major role to play in solving our housing crisis? Overplaying the contribution of self-build may in part be as a result of the wording of the commissioning letter by the prime minister which states: "The way in which our housebuilding market operates constrains the supply of new homes because there is not enough competition and innovation."

Is the root cause of our housing crisis the lack of competition and innovation, or are there more fundamental political and economic causes? What does the evidence tell us?

The roots of the crisis

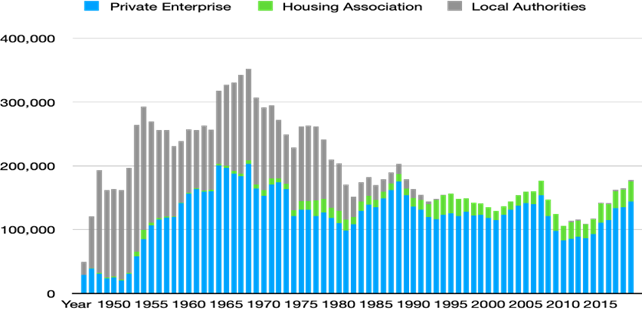

The housing crisis has been growing over the last 40 years and arguably before that with cuts in housing expenditure in the aftermath of the 1967 sterling crisis. Analysis of housing completions since the Second World War show that the government's target of 300,000 homes built per year cannot be achieved unless councils are given the freedoms and funding to build social homes for rent at scale.

Housing Completions 1945 – 2019 – Source MHCLG Table 244

The statistics also tell the story of the devastating impact of market cycles on new-build housing delivery. The demise of council house building to just 0.0014% of new homes by 2007, as well as the reduction in social housing grant by more than 50% as part of the austerity response to the post 2007-08 global banking crisis, has forced a greater reliance on the housing market for all forms of affordable housing. Funding from Section 106 Agreements, Community Infrastructure Levy and the increasing use of cross-subsidy from the sale of market homes by housing associations are all subject to the boom and bust cycle of the housing market.

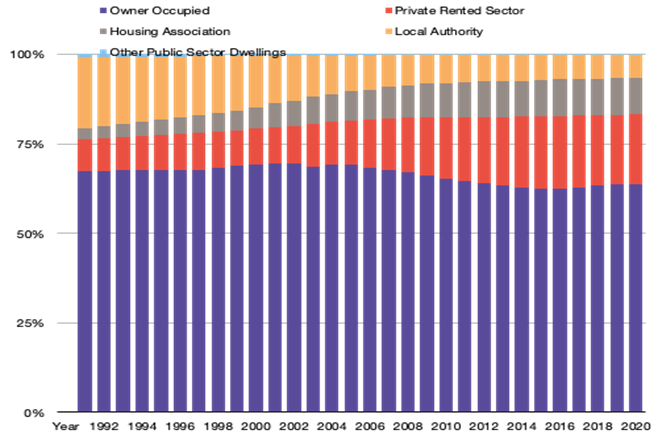

Structure of the Housing Economy

So, what has been the cumulative impact of the political policies and economic trends on the structure of the housing economy? The number of council homes peaked at 6.5m by 1980, when 31% of all housing stock was social rented. By 2013/14 this had reduced to 17% when the decline started to slow, reaching 16.6% by 2020. The private rented sector was stable throughout 1980s and 1990s at around 9% of all stock, only to more than double, peaking at 20.4% in 2016. It is currently slightly less at 19.5% of stock.

The right to buy council homes was introduced by the Conservative government in 1980 to increase home ownership and owner occupation initially increased peaking at 71% by 2003. It has since declined to 63% in 2013/14 and stabilised. The graph below clearly illustrates the rapid decline of council homes, and although housing association stock has grown, it has not kept pace with the rate of sales under the right to buy. Of the 4 million homes for social rent today, only some 1.6 million remain in council ownership.

Changes to the structure of the housing economy (source: MHCLG Table 109)

Law of unintended consequences

The graph also highlights one of the fundamental unintended consequences of housing policy. Instead of increasing homeownership, we have seen it decrease, with the private rented sector being the beneficiary. Why is this so? If this were to be a deliberate policy, it would win few votes at the ballot box. In the late 1990s rent controls were removed, assured short tenancies became standard and lenders introduced the buy-to-let mortgage.

But the politicians of the day were unlikely to have predicted that the policy of right to buy would be a major driver of the growth in the private rented sector. Over 40% of homes bought under right to buy are now in the private rented sector and this will rise to over 50% by 2025 on current trends. Some communities, such as Milton Keynes, have over 70% of former council homes in the private rented sector.

Is the Bacon Review the solution?

What does the Bacon Review have to say about the structural imbalance in the housing economy? It focusses mainly on the growth of the volume housebuilders and the lack of choice for people wishing to buy their own homes. It refers to the growth of self and custom build in other countries and makes recommendations to promote and encourage its growth in the UK. Doubtless, those that can afford to buy would benefit from greater choice and the opportunity to commission their own home, designed to meet their needs and aspirations.

Bacon is critical of the councillor who did not think that custom and self-build would meet the needs of his community and suggested that he should speak to those in housing need. Ask any desperate family on the council house register or in bed and breakfast accommodation, or their council housing officer struggling to find solutions, what is required to meet their needs. I suspect the offer of a self-build plot will be low on their list of priorities.

They would no doubt tell us what the evidence is clearly showing that the housing economy is suffering from a major shortage in social homes for rent. Bacon is without doubt a strong advocate of self and custom build and many of his recommendations have merit but on its own it is far from the silver bullet to the housing crisis that the Review implies.

There needs to be a step change in council house building supported and encouraged by the government. This will be needed more than ever if a possible COVID-induced recession dramatically reduces the supply of homes through the market with the consequential reduction in affordable homes.

What will be needed is a counter-cyclical approach. A counter-cyclical investment in zero-carbon council housing will give the economy the green-growth injection it needs to bounce back post-COVID. The success of the Everyone In initiative shows what councils can do to respond to a crisis. However, to step up to the wider structural housing problem, the current trickle of housing authorities deciding to re-establish their Housing Revenue Accounts needs to become a flood.

For the longer, full original version of this article please read the Autumn 2021 edition of the ACES Terrier.

Find out more

CIPFA's Housing Advisory Network holds regular webinars on zero carbon homes, housing finance and setting up Housing Revenue Accounts and 30 Year Business Plan Development.