Findings from CIPFA's council tax survey 2023

Government figures released on 23 March 2023 announced council tax increases at 5.1%. This confirmed the findings from CIPFA's own 2023 council tax survey taken earlier in March that had found households facing increases of 4.9% for the average Band D property in England and Wales. This is a rise of 1.4% from our 2022 survey but, set within the wider economic landscape, not unexpected.

Councils are seeing costs rise, with spiralling inflationary increases, stretched staff resources and an increasing demand for services as more residents struggle with the impacts of the cost-of-living crisis. But even so this increase, which is significantly below current inflation figures hovering at 10%, will be the subject of debate and media coverage.

Decisions to increase council tax are not made in a vacuum. For council tax to increase there is a complex legislative process that needs to be followed. This must also reflect the referendum limit set by central government governing the size of any increase which is not identical for all types of council, for example district authorities without social care responsibilities increases are restricted to less than 3%, not 5%.

Detailed budget papers will have been prepared and options including savings, changing delivery approaches and financial pressures will all have been considered before any vote is taken in the council chamber.

Local politicians need to agree the level of council tax charged each year and through this system are directly accountable to the communities that elect them. The raising of council tax will have been carefully debated with decisions made in light of the financial position of the council.

The council tax that is raised is a vital part of the income used to keep council services running. Nationally in 2021/2022 £40bn was raised in council tax across the country.

However, council tax is only one of the sources of income used by Councils to pay for the goods and services they deliver. It is added together with grant income from government, business rates and other sources to finance council activities. The greater the income from grants or business rates, the less pressure a local authority places on council tax.

Still, grant and government funding have been reducing and demand for services has been increasing, which has led to pressure on council tax as a way of bridging any funding shortfall. This funding shortfall has been particularly evident in three councils where central government has intervened due to financial failures and we have seen these three councils being allowed to raise council tax above the national 5% level. The London Borough of Croydon, Slough Council and Thurrock Council have all been allowed to raise their council tax bills by 15% and 10% respectively.

Survey Findings

Variations in regional council tax

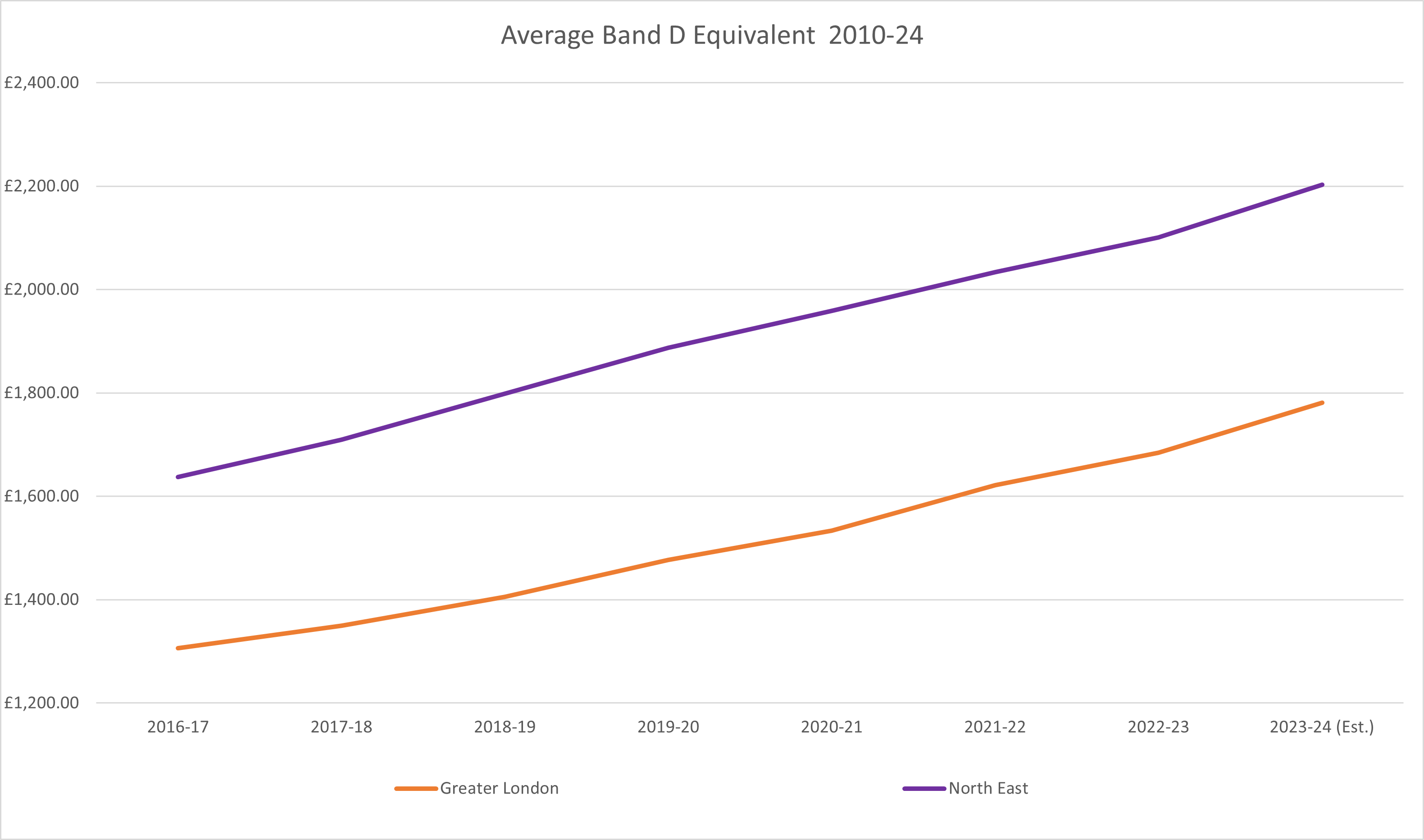

As shown in the chart 1 below, when we drill down into the figures, we see the repetition of a familiar pattern and that is the amount of council tax paid on an average Band D property in the North East is higher than a Band D property in Greater London.

The reasons behind this difference do not relate to a single isolated factor but a combination of factors that have influenced the present position, including:

Expenditure

Where expenditure is high, whether that is due to higher levels of demand or increased cost, the level of council tax requirement will need to go up unless other income sources can be increased, or savings made.

Grant income

Authorities receive grant income, based on a funding formula weighted to alleviate some of the variances attributed to high demand — a formula which is now considered to be out of date.

Business rates retention

Economic growth has not been equal across the country, leading to growing calls for a review of this funding stream and its redistribution.

Legacy and political context

Some councils will have historically lower council tax and the consequence of this is that, in subsequent years, those councils will have a lower monetary increase for the same percentage increase.

Chart 1

The figures from the CIPFA survey forecast that in 2023–2024, average Band D council tax in Greater London will be £1,781. This was very much in line with the government figures of £1789, while in the North East it is £2,202 which is a difference of £421. This in in comparison to an CIPFA survey of England and Wales aggregated Band D property of £2049.

However, the increase in council tax is highest in Greater London with a rise of 5.8% (increases higher than 5% occur as other organizations such as police and GLA can also add an increase to the council tax bill this is called a precept) this year which is 1% higher than the 4.8% increase seen in the North East. But as can be evidenced on Chart 1, this is not sufficient to erode the difference in the two figures and the divergence will continue.

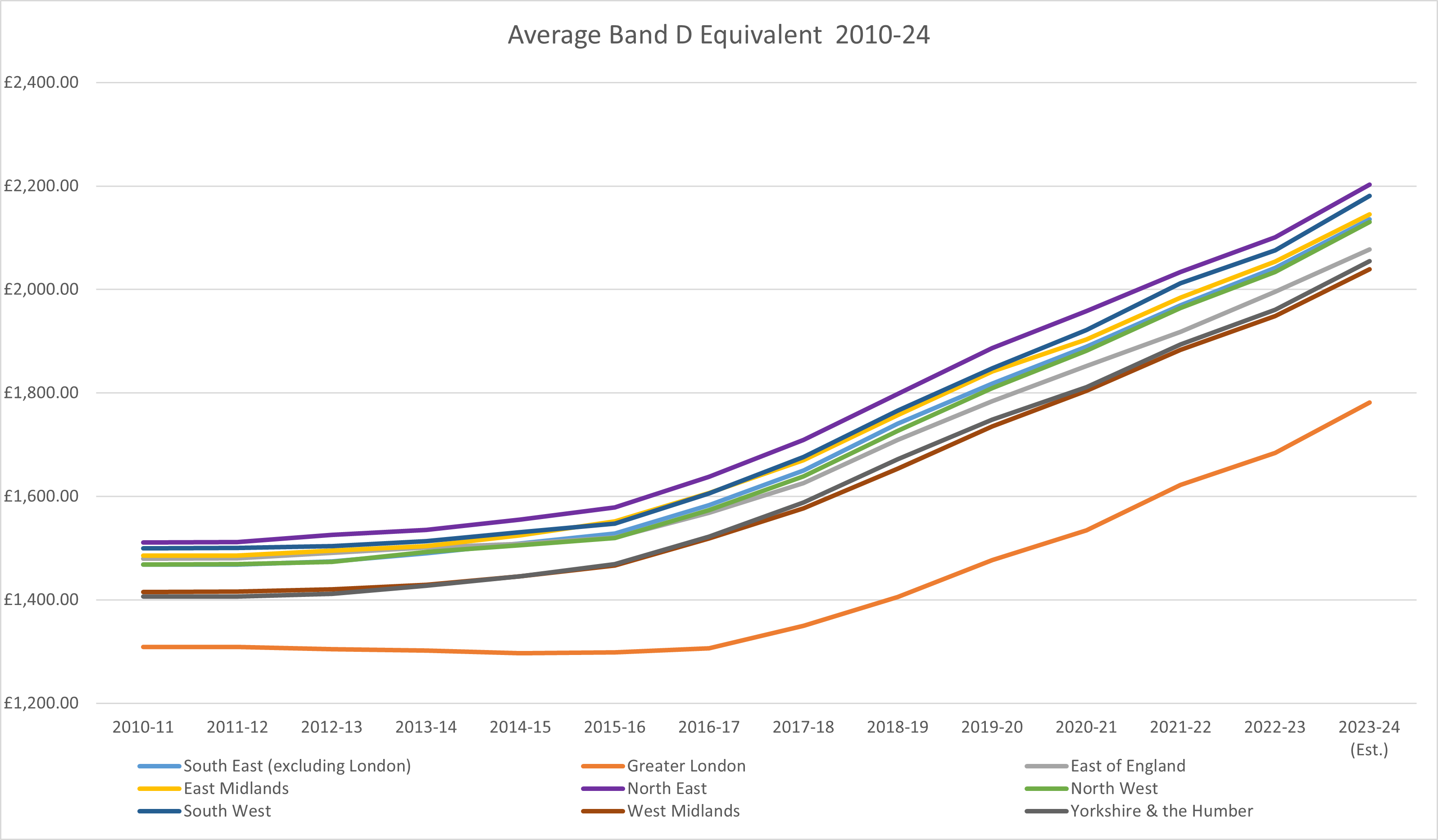

Chart 2

Chart 2 includes other regional areas in the survey and emphasises the increasing importance of council tax as an income source for local authorities across England and Wales. There has been a steady rise in council tax annually with this trend starting in 2015/16 for most authorities outside London where the increase becomes more pronounced from 2016/2017.

Funding gaps

A 5% increase in council tax across the country is not insignificant. This additional income will go some way to ensuring that services are maintained and continue to support communities in need. However, it would be naive to think that the money raised this year will relieve the financial pressures on councils.

Inflation is still running higher than we have seen it in 40 years and the cost of staff, energy and construction has increased beyond the expected budgets of most councils' medium-term financial plans. Therefore, even using the council tax head room we are seeing councils having to use reserves to balance their budgets and make significant decision on services.

People living in one Yorkshire authority will pay an extra 3.9% in council tax in the next year raising an additional £4m for the authority. But the council will still use £5.5m of its reserve to "further mitigate the pressures" in areas such as social care, energy costs, school transport and waste services.

A district council in Essex has reported that “to increase its share of council tax by 3% would bring in an additional £500,000.” When placed into the context of energy and fuel price increases it is understandable that for some authorities even after increasing council tax there is still a funding gap.

Supporting those in need

Acknowledging the rise in council tax is a necessity to bridge a funding gap. CIPFA’s Council Tax Advisor Adrian Blaylock reflects on the challenges faced by those struggling to pay, and calls for the support scheme to be reviewed and evaluated as part of the wider discussions:

“In 2013 the way that local government is funded changed. With a move to greater local democracy, emphasis was placed on keeping more income generated locally. The changes introduced in 2013 included the localisation of council tax benefit into local council tax schemes, determined, to a degree, by each local authority. Government protected pensioners, and therefore the scope of any local determination is limited to those of working age and influenced by the funding made available by council.

What this means is that those who need support from the local council tax reduction schemes may well find themselves in a position where someone living in a different local authority area, facing the same circumstances, will be expected to pay more, or less, council tax than them.

My concern is that universal credit is a standard amount across the country based on an amount needed to live off, yet there are those who are expected to pay an increasing proportion of their council tax liability, with others not being expected to pay anything.

Let’s include this discussion as part of the wider debate to ensure all those in need get the support they deserve.”

Conclusion

The problems with council tax and its regressive nature are well documented but for now it is a necessary part of raising funds for local government. This will not change unless there is a fundamental rethink and reform of the funding system.

While we talk of increases the results from the survey translate this to a maximum of £110 per year for Band D on a council tax bill in 2023-2024. So even though we must recognise the cost of living crisis and the hardships being faced it is important to be aware of the many services provided by a local council which could include leisure, parks, social care and housing.

This year has seen an emphasis on the accountability of elected members through the council tax system. In areas where councils have experienced financial failures, voters will see a significant rise in their council tax bill and will make a direct correlation between decisions made in the town hall with money coming out of their pocket.