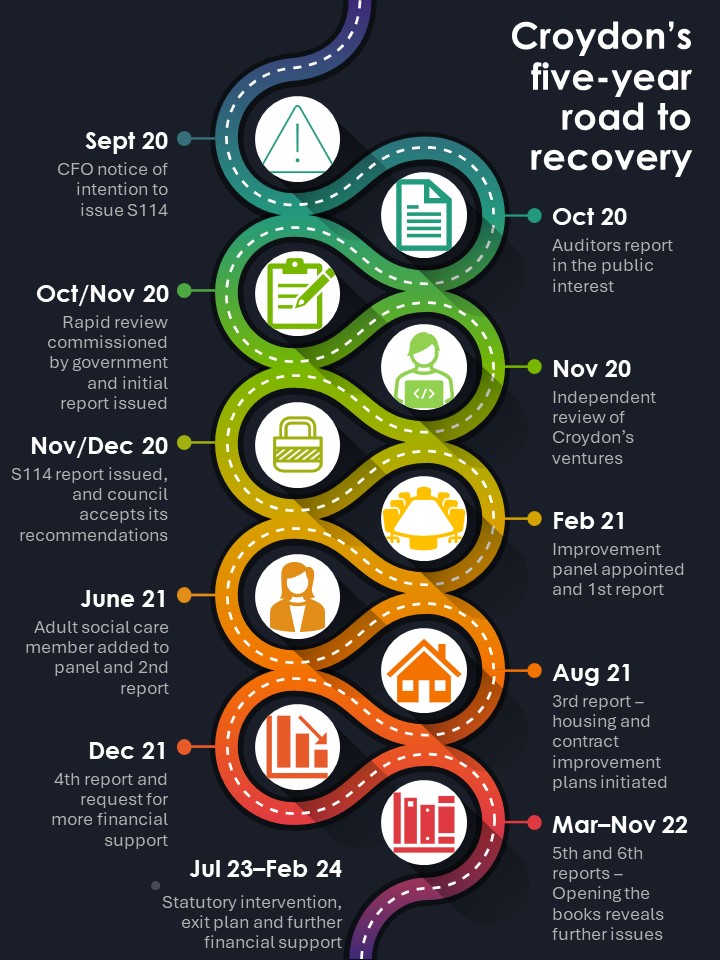

Overview

Signs of Croydon council’s financial distress first came to public attention in 2020, triggering a series of interventions aimed at restoring the council to financially stable footing. This briefing presents a timeline of non-statutory and statutory measures. In collating this timeline, CIPFA seeks to highlight the intensive and extensive nature of the interventions. As of March 2024, nearly five years after the initial intervention, Croydon council delivered £90m savings in 2021/22 and 2022/23. A further £36m savings delivery is planned for 2023/24 year. The council holds £1.4bn in predominantly unsecured debt and significantly lower valued assets that can be disposed to offset it.

There is now a plan for the council to exit intervention measures if certain milestones are met. It remains unclear how the legacy debt will be addressed, as it continues to dampen the council’s efforts to break even.

The extensive nature of intervention measures demonstrates the lasting impact of poor financial management. It further stresses the need to maintain sound financial management practices in line with the Financial Management Code and principles of good governance.

A snapshot of key events in the Croydon recovery process is presented below. Under each date there is a summary and links to the official (commissioner) reports about each stage of recovery. The commissioner reports contain a wealth of information that can help councils explore options for improving their governance and financial resilience in good times as well.

Pre-intervention

September 2020 – Notice of intention to issue S114 report

The chief finance officer writes a notice of intention to issue a S114 report to the CEO, monitoring officer, council leader and deputy leader. This fulfils the statutory requirement for consultation with statutory officers prior to the issue of a S114. A copy of the report was shared with MHCLG, the Local Government Association (LGA) and Grant Thornton, the external auditors.

October 2020

Read Grant Thornton's report on Croydon Council's financial position and governance

The report recommended key actions, including:

- rebuild reserves,

- re-consider the treasury management strategy for ongoing affordability of the borrowing strategy,

- review arrangements to govern interest in subsidiaries, how the subsidiaries are linked, the long-term impact of the subsidiaries on the council’s financial position and how the council’s and taxpayers’ interests are safeguarded,

- review use of transformation funding to demonstrate that the funding has been applied in accordance with the aim of the scheme.

October/November 2020

Rapid review commissioned

- Chris Wood was appointed to lead rapid review into the London Borough of Croydon.

- The review covered the council’s governance, culture and management of risk.

- The preliminary report found serious failings in governance, financial strategy and commercial investments.

- The report recommended a timeline of key actions for Croydon to avert statutory intervention.

November 2020

Read PWC's independent review of Croydon Council's property development entities

A report on Brick by Brick Croydon Ltd, growth zone, Croydon Affordable Homes LLP, the revolving investment fund and the asset investment fund. The report recommended that Croydon:

- update Brick by Brick financial governance, capacity, financial planning and reporting,

- reconsider business case assumptions for the growth zone,

- implement clear lending controls with well enforced drawdown requirements in the revolving investment fund,

- establish a ringfenced provision for the lifecycle costs of properties managed by Croydon Affordable Homes.

November/December 2020

The CFO issues S114 report, council accepts recommendations

The council responded to the S114 report, accepting the recommendations.

Non-statutory intervention

February 2021 – Improvement panel appointed and first report

- An Improvement and Assurance Panel was appointed, comprised of local government and finance experts.

- The Improvement and Assurance Panel first report was issued.

- The report made an initial assessment of the Croydon renewal improvement plan set out by the council.

- The report acknowledged the adoption of initial improvement plans for asset management and emphasised the significant work still to be undertaken to develop and implement the improvement plan.

June 2021

Appointment of adult social care panel member to the improvement board

June 2021

Second report from the Improvement and Assurance Panel

The second report highlighted further financial issues beyond those initially reported by Croydon, including:

- unpaid loan interest,

- the council’s services being delivered extensively through external contracts,

- poor contract management.

Further implementation of the improvement plan also reported including:

- contracts improvement plan initiated,

- forensic financial review by neighbouring CFOs initiated to review capacity, and financial management quality and process,

- programme management office strengthened,

- new performance management framework approved by council,

- children’s, families and education delivery plan set in motion.

August 2021

Third report from the Improvement and Assurance Panel

- A bid to buy Brick by Brick as a going concern was rejected by the council.

- A housing improvement plan is agreed to address the housing issues exposed by housing incidents.

- A Housing Improvement Board is constituted to be independently chaired and include representation from Croydon tenants and residents’ associations, the Local Government Association (LGA), London councils, voluntary and community sector and the Improvement and Assurance Panel.

- Contract reviews: a detailed review of all contracts with a view to identifying further saving opportunities through rationalisation and/or amalgamation of contracts.

- Forensic financial review reported: competent permanent finance staff, a need to restructure and recruit further permanent staff, further investment required in financial systems to support self-service and reporting, a requirement for organisation-wide training in financial systems use.

- There had been ‘churn’ in management and professional staff positions, with a parallel difficulty in recruitment.

- Slow pace of action reported on executive recruitment.

December 2021

Fourth report from the Improvement and Assurance Panel and additional capitalisation direction

- First warning about unsustainable housing and sustainable communities regeneration and economic recovery (SCRER) overspend.

- Exposure of housing maintenance failures in a block of flats in Regina.

- Shareholder and investment board oversight replaced by a shareholder cabinet advisory board – a member-only advisory board with any officer attendance in an advisory capacity.

- One-off funding to cover greater than usual asylum seekers and unaccompanied asylum seeking children (UASC) numbers in the borough: £2.36m.

- The children and young persons improvement plan being delivered.

- SEND local area leaders praised for increased pace of improvement.

- Twenty-six per cent of staff reportedly interim/agency.

- Waste Services PFI renegotiated.

- A cultural transformation framework produced to address organisational and cultural transformation with staff engagement at the heart of it.

A capitalisation direction of £50m provided for 2021/22 and an in-principle agreement to £25m of capitalisation support for 2022/23, subject to confirmation upon the continued progress of the council. Conditions of this support included agreement of an asset disposal strategy and significant progress in the closure of outstanding accounts.

March 2022

Fifth report from the Improvement and Assurance Panel

- Further warning about unsustainable housing and sustainable communities regeneration and economic recovery (SCRER) overspend.

- Housing improvement board (HIB) constituted.

- First housing improvement plan.

- Implementation of a new asset management system to monitor stock.

- New Housing Revenue Account (HRA) 30-year business plan.

November 2022

Sixth report from the Improvement and Assurance Panel

- Mayor elected, introducing new governance structure.

- ‘Opening the Books’ initiative initiated reveals legacy cost pressures up to 2022/23 of £74.6m.

- Significant levels of negative equity on its saleable assets (circa £300m), which effectively hindered the council’s ability to reduce debt levels through its asset disposal programme.

- Further S114 notice issued.

Statutory intervention and exit planning

On 20 July 2023, DLUHC moved the Improvement and Assurance Panel to a statutory footing until 20 July 2025.

The seventh report from the Improvement and Assurance Panel, issued in October 2023, highlights the need for further budget support, including:

- 14.99% council tax increase,

- £63m support for 2023/24 budget,

- £161.6m capitalisation direction.

The statutory board led the development of an exit plan setting out milestones and expected outcomes required for Croydon to transition out of statutory intervention.

In February 2024, Croydon requested further extraordinary support for the 2019/20 and 2024/25 financial years, which the government approved.

More on Section 114s

These resources help you navigate Section 114s, offering advice and guidance.