By Victoria Barnard, CIPFA Consultant (Local Government)

Local authorities are becoming more diverse than ever. As austerity bites, councils are reaching for innovative but sustainable solutions for themselves and their residents. Many of the schemes looking to increase economic growth or council income involve substantial capital investment, and the use of a more diverse range of financing approaches than ever before.

Such developments put the spotlight onto capital accounting and financing, and authorities need to be sure that they are at the top of their game in these areas – technically and strategically. A council may devote all its time and expertise to delivering the most exquisitely crafted plan for increasing economic growth, but if incorrect assumptions are applied to the capital accounting, or if decisions made about financing the scheme don’t recognise the full impacts across capital and revenue budgets then, at best, the authority will fail to reap maximum rewards in years to come – at worst, it may find itself in a funding crisis once the auditors have reached their conclusions.

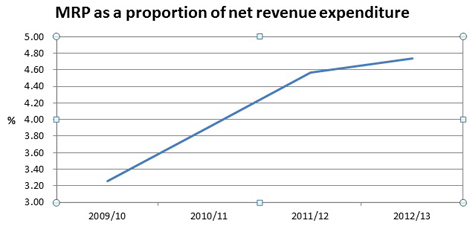

Alongside the need for confidence in the detail on individual schemes, authorities need to get the most out of their overall capital finance decisions. Looking at data held by CIPFAstats, we can easily see the ever increasing load placed on revenue budgets by past and present capital expenditure. The plot below shows the increasing ratio of average Minimum Revenue Provision (MRP), the annual revenue charge made each year to spread out the impact of commitment to borrowing as a result of capital expenditure, to average net revenue expenditure for English local authorities over the last four years:

Note: Includes Police and Fire, excludes GLA.

While both capital and revenue expenditure have dropped over the period shown, MRP has risen, increasing by 43% for all English authorities and more than tripling for non-metropolitan district councils.

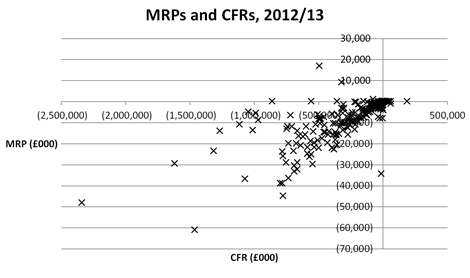

Of course, the Prudential and Treasury Management Codes offer authorities a lot of freedom in their capital financing decisions. Councils’ uptake of this flexibility is illustrated by a plot of MRP against Capital Financing Requirement (CFR), the measure of an authority’s commitment to borrowing, which shows that there is no single rule of thumb being applied across the community:

Note: English authorities only. Includes Police and Fire, excludes GLA. CFR values are adjusted to remove impact of HRA self-financing debt as this is not directly related to MRP. Birmingham City Council (MRP £132.7 million, adjusted CFR £3,740.1m) has been excluded due to scale.

As with any rising cost at a time of diminishing budget, the derivation of an authority’s MRP charge should be under significant scrutiny – whilst it cannot be simply reduced when there’s less revenue budget available, prudent and sustainable approaches to financial management will also ensure that the charge is not unfairly punishing in any given year. For example, an authority finding itself nearer the bottom right than the top left of the above plot might question why it appears to be paying a relatively high MRP charge; does it indicate room for reduction in the charge?

To have confidence in its MRP calculation, a council needs to review both its capital accounting and financing decisions, ensuring that expert technical knowledge works in tandem with strategic resource management to put the council in the best possible position.

- Victoria is a CIPFA expert in the area of financial management and capital accounting.