Findings from CIPFA's council tax survey

CIPFA's 2022 council tax survey found households facing increases of 3.5% for the average Band D property in England and Wales. While the fact that council tax has risen will hardly come as a surprise, this year's increase comes at a time when households are already facing significant inflationary pressures. Against this broader economic context, council tax rises can perhaps appear less significant.

However, it's long been known that council tax is regressive in nature, and any increase will add to the burden of those already struggling — much as the recent eye-watering energy bill hike will be felt most acutely by those with lower incomes. The £150 council tax energy rebate provided by government to all households in Bands A to D will reduce some of that burden, but significant liability will remain.

Councils across the UK will have recognised and considered the financial pressures council tax places on local communities. However, implementing increases is often necessary to fund essential services and remain financially sustainable. The level of these increases is not consistent across the regions, with our research finding a large variation in the average council tax paid by band D households. This seems to run contrary to current political rhetoric, with the national policy agenda dominated by talk of levelling up.

This briefing begins by looking at the findings of the 2022 survey, highlighting such variations, followed by CIPFA revenue advisor Adrian Blaylock's assessment of what could be done to reform the situation.

Survey Findings

Variations in regional council tax

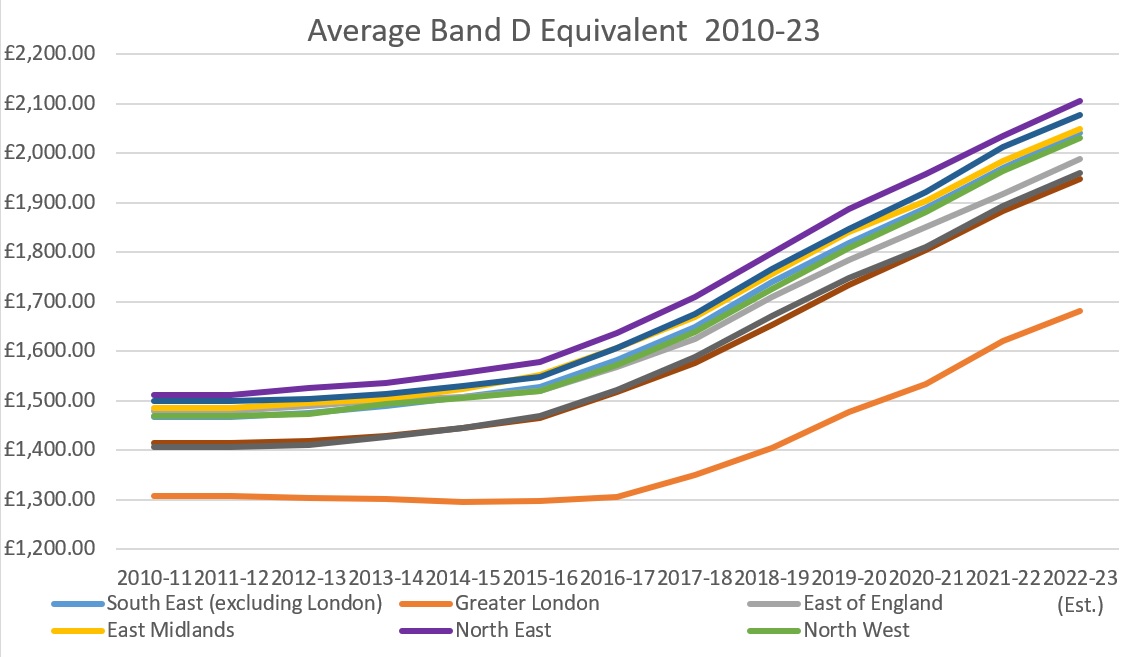

Data from the 2022 survey shows a continuing regional difference in the average Band D council tax. As shown in the chart below, that variation has existed for over ten years, with Greater London consistently lower than other regions, while the North East is consistently higher.

Chart 1

In 2010/11 the average Band D council tax bill in the North East was £1511, in comparison to £1308 in Greater London — a difference of £203. By 2022/23 this had reached £2105 in the North East, £423 higher than the £1682 paid in Greater London.

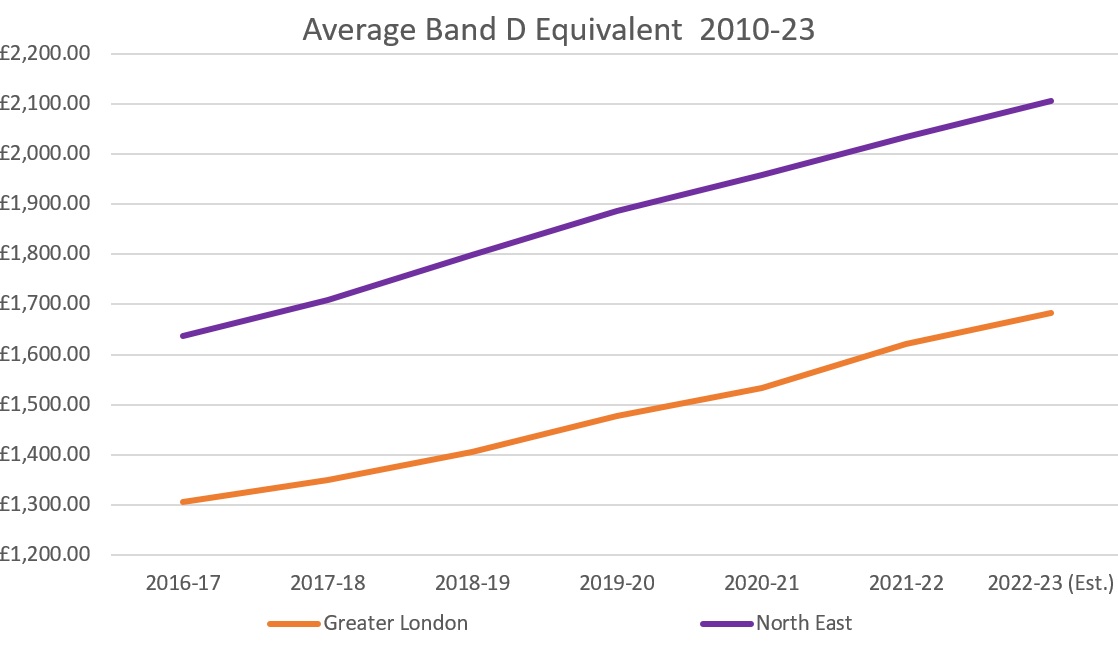

Chart 2

Jeffrey Matsu, CIPFA Chief economist, explains that this variation is "despite the fact that the median weekly household income in the North East is the lowest in the country (£480), compared to London which has the highest (£615). Meanwhile, the composition of the labour market is equally staggering with 17% of workers in the North East employed in low-paid jobs, more than double the proportion in London.

"Council tax reflects house values from 30 years ago, [meaning] its regional impacts can be quite varied. Importantly, high regional variability of council tax coincides with noticeable divergences in local economic context."

The need for change

Calls for council tax reform have so far failed to gain much political momentum, despite detailed research by the IPPR identifying numerous failings, including this lack of regional parity. At a time when there is considerable talk around levelling up, with a White Paper stating "12 bold, national missions" for national economic policy, it would seem to be a good opportunity to look again at council tax and reflect on the reasons for change.

Here, Adrian Blaylock further deconstructs council tax, in the process explaining some of the main causes of inequality. This high-level explanation covers how council tax is set, why the levels vary, and ideas for a way forward.

How is council tax set?

The council tax requirement calculation is governed by legislation and is, in effect, the difference between estimated expenditure and estimated income. In simple terms, the greater the income from grants or business rates, the less pressure a local authority places on council tax. Over the last ten years the reduction in grants has resulted in some regions facing greater funding pressures than others.

This does not mean all authorities are affected in the same way by changes to their income streams. As we have seen in the past strong financial management, good governance, other income sources, and effective use of reserves all play an important part in the resilience of an authority.

Why do levels of council tax vary?

Four main areas impact council tax inequality, although we recognise the huge complexity of the task of balancing a local authority budget, something explored in detail in the CIPFA publication Balancing Local Authority Budgets.

Expenditure

No two areas are identical in their demographics or needs. If expenditure is disproportionate, then there must be either an equally disproportionate level of demand or level of cost. Various factors can impact on both: some argue that higher levels of deprivation increase demand for some services, while others contend that sparsity adds to the cost in more rural areas.

Where expenditure is high, whether that is due to higher levels of demand or increased cost, the level of council tax requirement will need to go up unless other income sources can be increased, or savings made. While some authorities may use reserves, this is not a permanent solution.

Grant income

Each authority receives a specific amount of grant income, based on a funding formula weighted to alleviate some of the variances attributed to high demand — a formula which has not been updated for several years. A governmental review into how need is assessed and under what basis grant income is calculated was launched in 2016, with an aim of implementation by April 2020, but has since been delayed.

In CIPFA's opinion the review was flawed as, while it aimed to redistribute the funding already in the local government funding system, it did not increase the level of funding available.

Business rates retention

The introduction of business rates has resulted in growth for some authorities, while others have suffered from decline — some have financially benefitted from this tax more than others. At its inception, the government calculated two baselines for every billing authority: the level of business rates one could achieve, and the amount of funding from those rates an authority would need.

Where an authority's ability to raise income from business rates exceeds its need, it's required to pay said excess to government as a 'tariff.' Meanwhile, when an authority's need exceeds its ability to raise income from business rates, it receives a governmental 'top-up' payment. In theory this means that the overall level of income from business rates is redistributed around the country.

While the levels of top-up and tariff are increased each year according to inflation, the calculations used to establish the baselines have not been revisited since their introduction. This means authorities who have seen growth will have benefitted from an increased income, whereas those who have experienced decline will find they need to raise additional income to meet this shortfall.

Legacy and political context

It's important to note setting the council tax is not just a budgetary exercise, as there is a significant political dimension to the decision-making process. While council tax can be increased to a maximum threshold set by government, some councils will set lower rises. The consequence of this is that, in subsequent years, those councils will have to forgo that % increase.

Council tax rates also reflect the historical decisions made around grants paid to local authorities that froze or reduced council tax between 2011/12 to 2015/16. This grant still effects the tax, with these councils starting from a lower level than those who chose not to receive the grant.

Potential solutions for reducing council tax inequality

It's fair to say the council tax system introduced in 1993 still bears some resemblance to the system in place today. However, a shifting financial landscape and other pressures have brought us to the point where council tax is no longer equitable. Reform is needed, as our suggested solutions show.

Reviewing needs and redistribution

It is important that the fair funding review addresses imbalances in the cost base, with the funding needs formula updated to accurately reflect need. This should be evidence-based, using the most up-to-date data possible. The review should also consider future pressures in order to remain relevant.

Non-Domestic Rates reset

To ensure business rates are distributed based on need and the ability to raise income, the baselines need to be reset. CIPFA would also recommend reconsidering an alternative model for rates retention as a potential solution. As traditional business models change to better serve our rapidly-shifting world, business rates need to be set with this wider context in mind.

Council tax reform

In the spirit of devolution, the government should consider implementing changes to local council tax support, discounts, and premiums. This will enable local government to maximise the income they can achieve, while still supporting those most in need. We recognise that form should follow function, and discussion of this type must reflect broader national policy considerations.

Conclusion

Average Band D Council tax has increased in 2022/23 as it has done every year since 2010/11. This year has seen a greater divergence between the lowest level of Band D council tax and the highest level. This disparity needs to be fully understood and addressed, and failure to do so will mean that those on the lowest incomes will continue to face high council tax.

While this year's will seem less significant in the face of other inflationary costs, such as energy and fuel, they should not be dismissed. Reform is needed, and the context of the levelling up agenda would be a good place to start.