Why are we talking about this?

CIPFA held its 6th ‘Big Discussion’ event in May where we ran a series of polls relating to topics our members told us they wanted to discuss with their peers. One of the topics was around remote working and what this might mean for office space strategies.

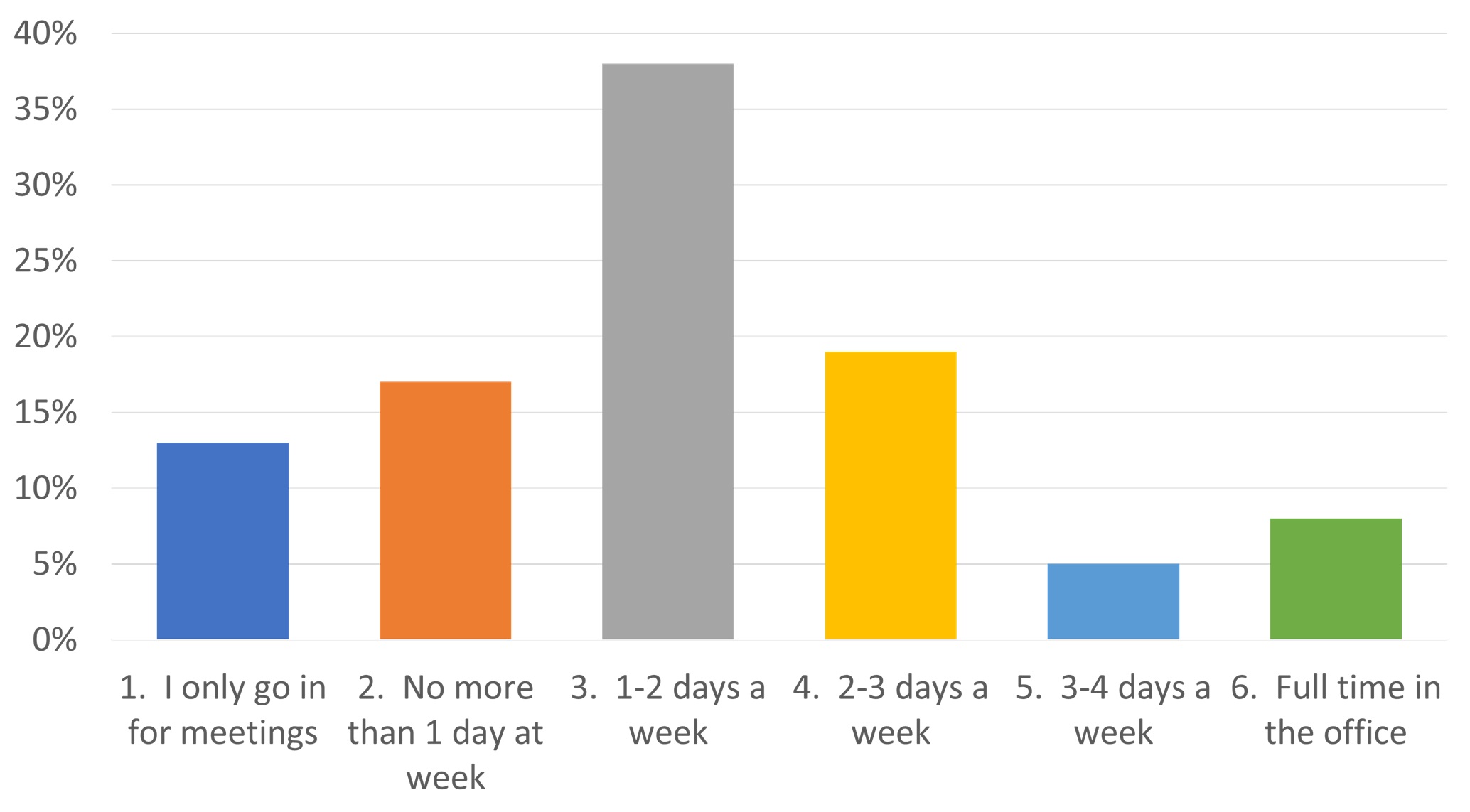

We asked: Following the pandemic, has your organisation moved to a remote way of working?

The results (see Figure 1) indicated that over 50% of local authorities have moved to a remote way of working.

Figure 1, Big Discussion poll results, 24 May 2023, 60 responses

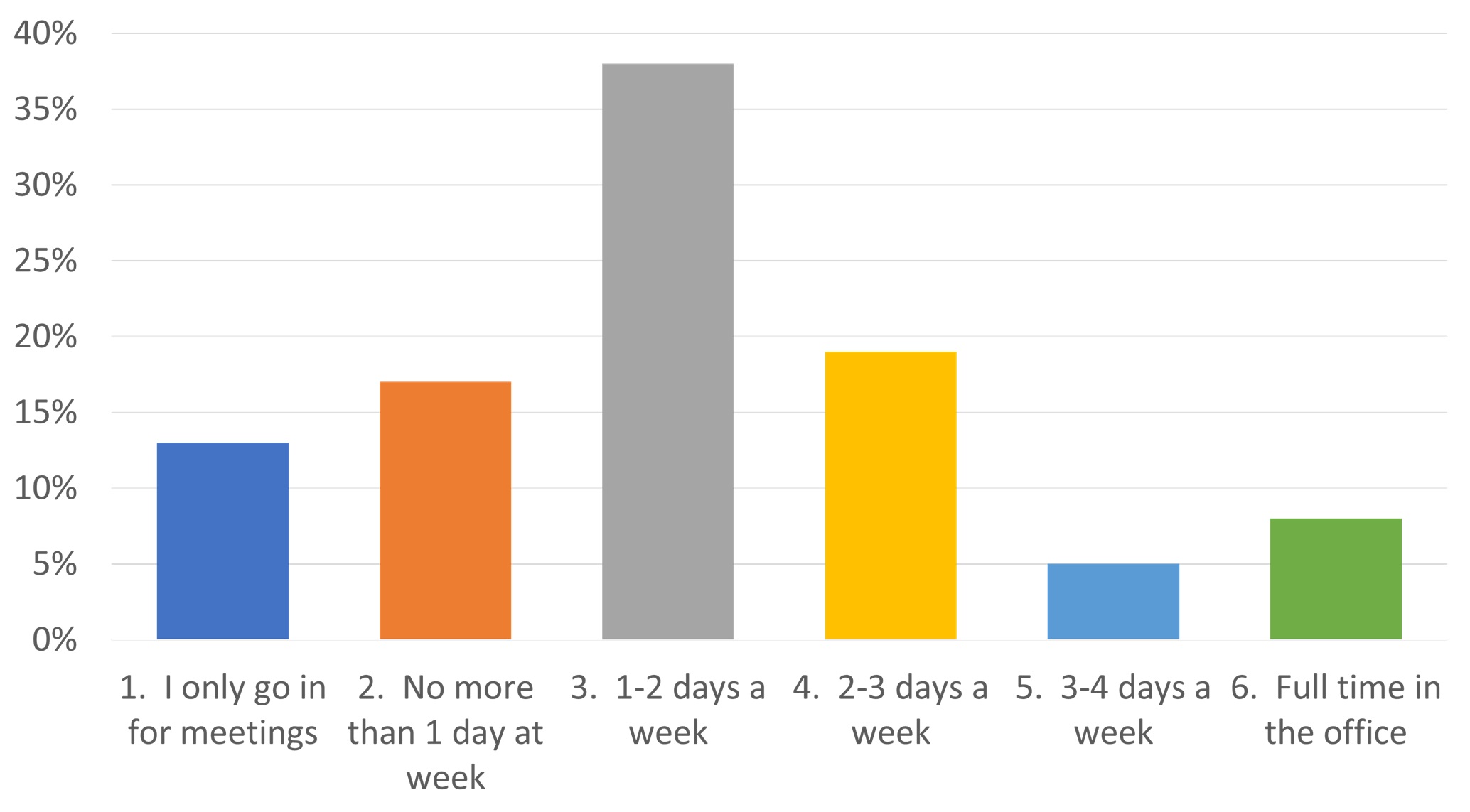

We asked: On average, what proportion of your working week do you spend in the office?

68% indicated that as a proportion of their working week, they now only go into the office for meetings or for 1 or 2 days. (See Figure 2).

Figure 2, Big Discussion poll results 24 May 2023, 63 responses

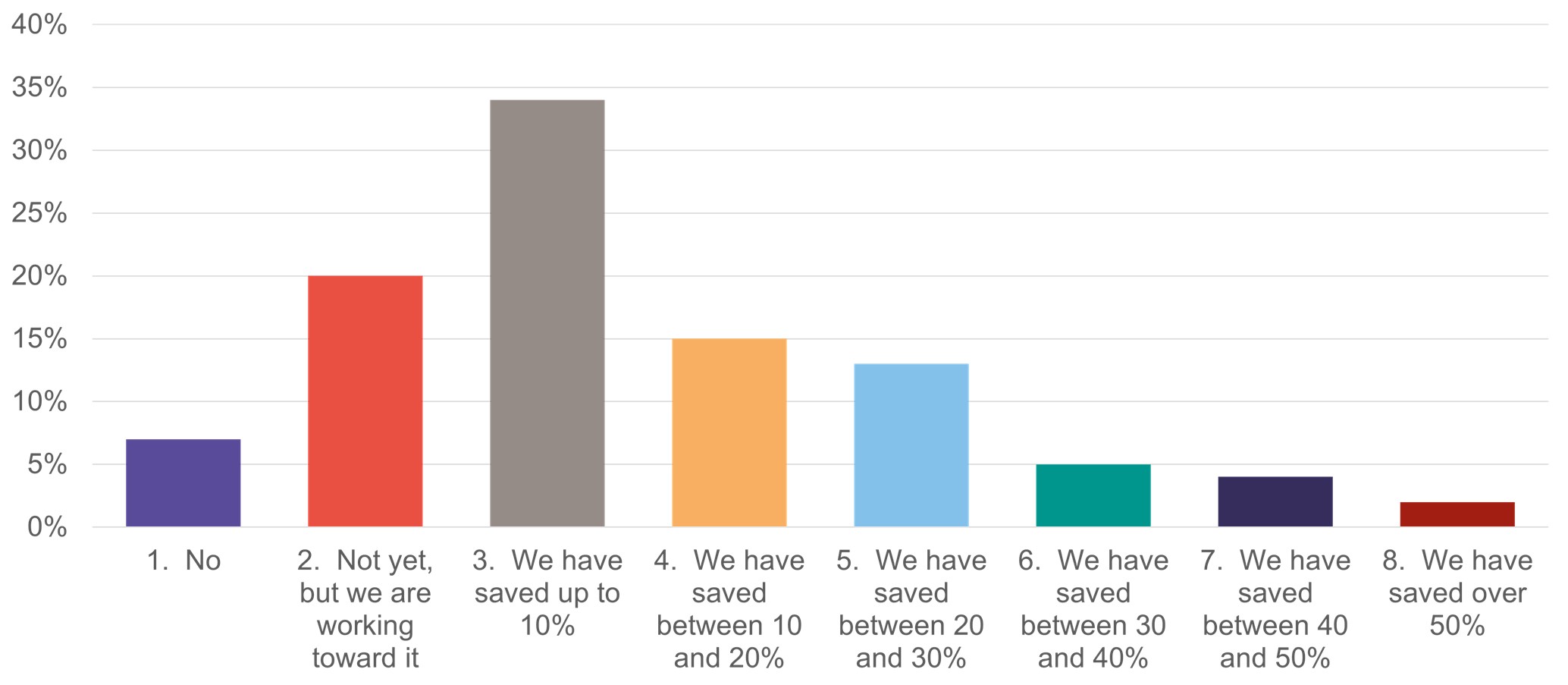

We then asked: Has your organisation reduced office space post pandemic?

Figure 3, Big Discussion poll results 24 May 2023, 55 responses

This trend is a pattern we’ve seen in local authorities across the country and many of you I’m sure will be aware that our owner-occupied offices now include a lot of un-used accommodation.

What does this have to do with asset valuations?

For the purposes of capital accounting, owner occupied offices will be categorised as operational property, plant and equipment (PPE), and valued on the basis of Existing Use Value (EUV).

Here, the valuer is required to assess what it would cost to replace the service potential (i.e., what would be needed to deliver the service if deprived of the asset) at least cost. Part of the consideration will be whether there are parts of the building currently unused and whether the authority has any intention of re-using the vacant parts. If on inspection, there is clearly a good deal of underused accommodation, a discussion with the client will be required to determine the intention for that space if not already clarified in your instructions.

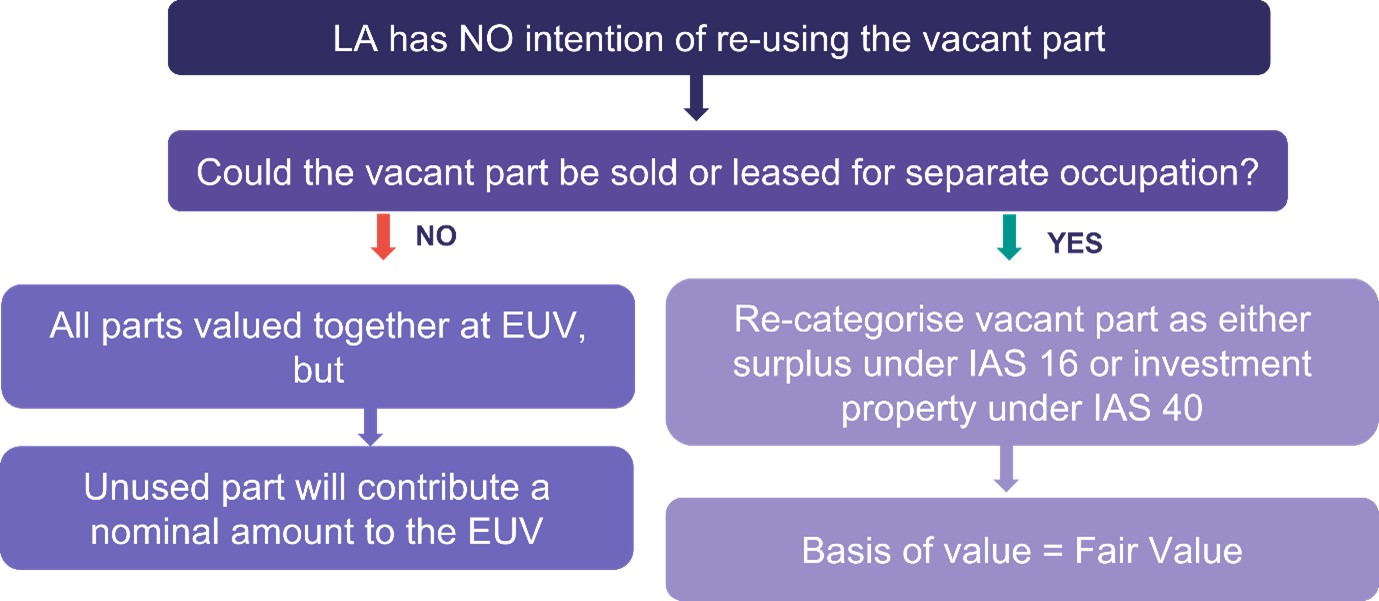

If the local authority has no intention of re-using the vacant part, the next question is whether the vacant part could be sold or leased off for separate occupation, without impeding the use of other parts of the building. If the answer is yes, then that part will be re-categorised as either Surplus PPE or as Investment Property and the basis of value applied will be Fair Value.

You still have 100% of the property valued for balance sheet purposes but you’d have separate valuations, stated separately in the report, for the operational in-use and the vacant part. The parts in operational use would be valued on an EUV basis and the vacant part on the basis of Fair Value.

There will be instances where the vacant space can’t be released for separate occupation – say for example the building configuration might not allow it or there might be security concerns. In these circumstances, then all parts of the building will be valued together on the basis of EUV, but the vacant part will only contribute a nominal amount to the value.

For example, if you have a building with 4 floors, one floor isn’t being used but it can’t be released for separate occupation, then the unused floor will contribute only a nominal amount to the property’s EUV. This is because the service potential of the vacant floor would not be required for continued service delivery.

The flowchart below illustrates the concept:

Given current trends in the use of office space, this is one for the preparers of accounts and valuers to watch out for this year. For further information on EUV, see RICS Valuation – Global Standards 2017: UK national supplement UK VPGA 6. Later in the year, the RICS are due to publish a revised edition of the Red Book UK supplement with updated guidance on EUV, along with a new dedicated Professional Standard titled Existing use valuations for UK public sector financial statements.

In the meantime, please feel free to contact the property team at CIPFA to discuss any asset valuation queries you might have at property@cipfa.org.